All Posts (2129)

MARCH MARKETING MADNESS - Investor Marketing Tips A-E

Starting March 1, investors can once again own and finance up to 10 individual properties and get Fannie Mae backed loans. The limit had been previously reduced to 4. This meant that an investor with 5 properties, great credit, and documented income could not finance an investment property without bringing in a partner or resorting to creative financing methods.

Undoubtedly, we will see increased activity from investors who had been halted by the limit.

In lieu of March Marketing Madness (a stimulus plan aimed at connecting agentswith these emerging investors), to help agents grow their business with realestate investors - every day I will post a new tip that can help you with yourinvestor clients and prospects.

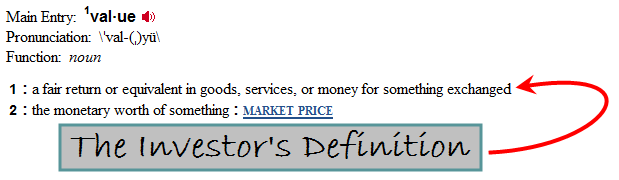

ADD VALUE to the service you provide.

To retain clients, gain referrals, and increase recurring business - you need to do something special to set yourself apart from your competition. There are many different ways to ADD VALUE to the service you provide for your clients, and providing resources is one of them.

Owning rental property is tough, and real estate investors have a lot of pain points - like finding a handyman and other good resources. One easy way to ADD VALUE to your services is by helping solve these pain points. You can stand out from other real estate professionals by learning about your clients' wants, identifying their obstacles and pain points - and then pointing them in the direction of resources that can help. ADD VALUE to your services by educating yourself, becoming more knowledgeable for your clients, and by exhibiting a "how can I help" mentality that will keep clients coming back to you.

BE KNOWN in the areas you want to serve.

Make it your priority to BE KNOWN in your area - you won't get very far if no one knows about your business. Get to BE KNOWN amongst all the local business owners and group leaders. Contribute to local organizations and participate in venues where you can volunteer your services. The more people who know about you and the service you provide - and the better off you'll be.

Real estate investors know what they want and don't have trouble looking for it. Very often, they will rely on their network and referrals. When a client is looking for a service in your area, you want to be at the top of the list of known individuals who can provide it. Think of this as SEO (search engine optimization) - but in real life, not on Google. When an investor wants to purchase in your area, they will search through their network first, and use the recommendation that comes their way. You want to BE KNOWN within this network that they are using to search for results.

CREATE TAB to attract Investors

Many real estate agent sites are limited because of their "for buyers" and "for sellers" appearance. CREATE an INVESTOR TAB with resources that aren't focused on an immediate real estate transaction, it will help you connect with clients on a long term.

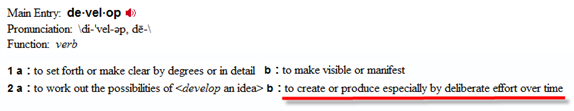

DEVELOP RELATIONSHIPS to last a lifetime.

Your relationship with clients and prospects should go far beyond real estate. When you DEVELOP RELATIONSHIPS with your clients to let them know they are more important to you than just a real estate transaction, the business opportunities will last a lifetime.

EDUCATE CLIENTS to make good decisions.

EDUCATE CLIENTS, so that they can make good, informed decisions. Turn yourself into an asset by providing valuable information that helps your clients make their decisions. This is a fundamental strategy you must use to keep them coming back to you.

Clients need your help to make their decisions - they don't want you making decisions for them! A good decision is the result of having the right information and making the correct choice. Investors are long term repeat clients who know what they are looking for, and they need you to provide the right information so they can make the right choice. If you don't provide investors with information that can make them feel confident about the choices you have available, they don't have a reason to be confident in yourservices. So its important to EDUCATE CLIENTS, because providing them with good information lets them know that you are there to help them make the decisions that are right for them.