REOPro Launches www.MatherNetwork.com for Investors

Friday 2/8/2013, REOPro, the nation's largest foreclosure network of agents, asset managers, attorneys, property preservationist and others, launches a sister site, www.MatherNetwork.com, focused on self directed real estate investors.

As with REOPro, the Mather Network has blogs, forums, real time live chat, video sharing, event calendar, group creation and much more however, it's soon launching a new tool to put the investor and investee together.

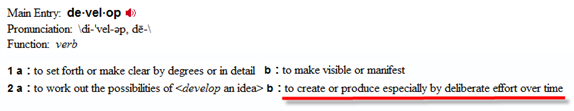

InvestConnect will give investors the ability to advertise what type of real estate investments they are looking for as well as give investees, those with deals, the ability to come on and search for potential investors. The best part of the InvestConnect tool is that it works in reverse as well. The tool allows investees, those with deals, to advertise their opportunities while investors, those with money, can come on line and search through the different opportunities. Making the network much more than a social media tool but more of a "E-harmony " or "Match.com" for investors and investees.

InvestConnect is on schedule to launch towards the end of March however, current membership of www.MatherNetwork.com and those who join before the launch of InvestConnect, will get access to the tool for the first 12 months free, at no cost. When REOPro's founder, Jesus "Jesse" Gonzalez was asked about how much the tool would cost he explained,

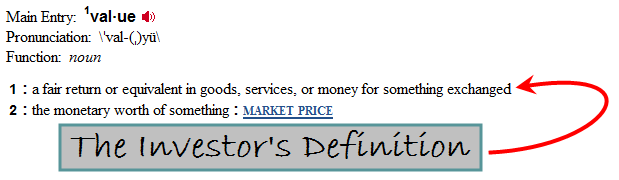

" As always, membership to the network itself will be free however, this new tool comes with some cost and that cost must be paid for. REOPro has built a reputation based on adding value and keeping cost low....or non-existent all together and, I expect the Mather Network to maintain this strategy by working closely with advertising partners to keep InvestConnect cost low. At this time, I don't have an exact figure however, I assure you, it will be highly competitive to other tools on the market and best of all, as the network grows, as membership in InvestConnect grows, we can use increased funds to put towards R&D to make the tool better. Our biggest advantage is our low cost of operation and I will use that advantage to its fullest potential by keeping cost low, providing excellent value and ensuring our members are not just satisfied but, become our raving fans."

REOPro is proud of the Mather Network and looks forward to it becoming a valuable resource for its members with education, advocacy, social media and wealth building tools. For more information on the Mather Network, you can visit their site at www.MatherNetwork.com or contact Jesse Gonzalez Directly at JGonzalez@RealTracs.com