listings (37)

The Wisconsin housing statistics are in for April of 2014. Here is an excerpt from what the Wisconsin Realtors® Association (WRA) had to say:

The Wisconsin housing statistics are in for April of 2014. Here is an excerpt from what the Wisconsin Realtors® Association (WRA) had to say:

Wisconsin existing home sales fell in April even as median prices continued to rise according to the most recent analysis of the state housing market released by the Wisconsin REALTORS® Association (WRA). Home sales declined 11.6 percent in April compared to the same month last year due to a combination of higher home mortgage rates, higher prices and harsh winter temperatures. Median prices rose over that same period, increasing 1.4 percent to $139,900.

“As we enter the second quarter of the year, we have been expecting some improvement in home sales, but it’s important to remember that April sales are still impacted by the February weather given the 6 to 8 week lag between the time an offer is accepted and a closing takes place,” said Steve Lane, chairman of the WRA board of directors. He also noted that there were heavy snows in the northern part of the state as late as mid-April 2014. Every region of the state experienced a decline in April sales. The Central region fared the best, falling just 3.8 percent over the April 2013 to April 2014 period, followed by the Northeast region which dropped 8.5 percent over the period. The South central region fell 9.6 percent and the Southeast region saw a decline of 10.1 percent. Finally, the North region dropped 17.4 percent and the West fell 25.5 percent. Interestingly, home sales fell more substantially in the metropolitan counties which averaged a 13 percent reduction in sales in April compared to rural counties which declined 7 percent between April 2013 and April 2014. “This may be due in part to much tighter inventories in the urban counties compared to rural counties,” Lane said. Rural counties had just over 14 months of available inventory in April compared to just 6.9 months for metropolitan counties.

Below are the number of Home Sales and Median House Prices for the state of Wisconsin, Rock County, and Dane County. These stats include Janesville and Madison. Feel free to contact me if you have any questions pertaining to these figures. As you probably have heard, overall home sales & prices have been increasing over the past few years. This month however showed a decrease of home sales statewide, but an increase in home prices.

Thinking of purchasing a home before prices or rates rise any further?! I'd be happy to show you any homes currently listed for sale. Feel free to visit Home Listings in Rock County to search for current Rock County properties or visit Home Listings in Dane County for homes in Dane County Wisconsin.

Now might be the right time to sell your Wisconsin home. Feel free to take a look at our cutting edge Rock Realty Marketing Plan! If you would like some insight into how much your home is currently worth, I would be happy to provide you with a free comparative market analysis. This is a report that gives a close estimate to what your home might sell for in your current local Wisconsin real estate market. Click below:

What's My Wisconsin Home Worth?

Has your home value fallen below what you currently owe? Have you experienced a hardship like divorce or job loss? A short sale may be right for your situation. Visit our page on Wisconsin Short Sales for more information.

Housing Statistics for the State of Wisconsin:

March 2014

Home Sales: 5,369

Median Home Price: $139,400

March 2013

Home Sales: 6,003

Median Home Price: $138,000

Housing Statistics for Dane County, WI:

March 2014

Home Sales: 590

Median Home Price: $210,000

March 2013

Home Sales: 701

Median Home Price: $209,900

Housing Statistics for Rock County, WI:

March 2014

Home Sales: 170

Median Home Price: $115,000

March 2013

Home Sales: 175

Median Home Price: $105,000

View my report from last month. Wisconsin March 2014 Housing Statistics

The Wisconsin housing statistics are in for March of 2014. Here is an excerpt from what the Wisconsin Realtors® Association (WRA) had to say:

The Wisconsin housing statistics are in for March of 2014. Here is an excerpt from what the Wisconsin Realtors® Association (WRA) had to say:

Home sales dropped for the third straight month in Wisconsin as the frigid temperatures and hefty snowfall continued into March, according to the latest analysis of housing market activity released by the Wisconsin REALTORS® Association (WRA). Compared to March 2013, home sales declined 11.3 percent in March 2014, which contributed to a weak first quarter. First-quarter sales fell 8.5 percent compared to the first quarter of 2013. However, the median price of existing homes rose a modest 1.9 percent to $136,500 over the period between March 2013 and March 2014. Median prices were up 4.2 percent for the first quarter relative to the same quarter last year.

“Even with spring officially arriving in the middle of March, the spring selling season has been slow to gather steam,” said Steve Lane, chairman of the WRA board of directors. “We are hopeful that the spring thaw will jump-start the selling season that traditionally gains momentum in the second quarter,” Lane said. Still, Lane noted that the first quarter sales remain above their levels of two years ago — a year that had a relatively mild winter by comparison.

Below are the number of Home Sales and Median House Prices for the state of Wisconsin, Rock County, and Dane County. These stats include Janesville and Madison. Feel free to contact me if you have any questions pertaining to these figures. As you probably have heard, home sales & prices have been increasing over the past few years. This month again showed a decrease of home sales statewide, but an increase in home prices. Dane County's prices increased around 4% in March, year over year, while Rock County's median home price stayed nearly the same. Rock County did show an increase in home sales though, in contrast with the rest of the state.

Thinking of purchasing a home before prices or rates rise any further?! I'd be happy to show you any homes currently listed for sale. Feel free to visit Home Listings in Rock County to search for current Rock County properties or visit Home Listings in Dane County for homes in Dane County Wisconsin.

Now might be the right time to sell your Wisconsin home. Feel free to take a look at our cutting edge Rock Realty Marketing Plan! If you would like some insight into how much your home is currently worth, I would be happy to provide you with a free comparative market analysis. This is a report that gives a close estimate to what your home might sell for in your current local Wisconsin real estate market. Click below:

What's My Wisconsin Home Worth?

Has your home value fallen below what you currently owe? Have you experienced a hardship like divorce or job loss? A short sale may be right for your situation. Visit our page on Wisconsin Short Sales for more information.

Housing Statistics for the State of Wisconsin:

March 2014

Home Sales: 4,588

Median Home Price: $136,700

March 2013

Home Sales: 5,160

Median Home Price: $134,000

Housing Statistics for Dane County, WI:

March 2014

Home Sales: 490

Median Home Price: $203,000

March 2013

Home Sales: 534

Median Home Price: $195,000

Housing Statistics for Rock County, WI:

March 2014

Home Sales: 149

Median Home Price: $102,900

March 2013

Home Sales: 133

Median Home Price: $103,000

View my report from last month. Wisconsin February 2014 Housing Statistics

The Wisconsin housing statistics are in for February of 2014. Here is an excerpt from what the Wisconsin Realtors® Association (WRA) had to say:

The Wisconsin housing statistics are in for February of 2014. Here is an excerpt from what the Wisconsin Realtors® Association (WRA) had to say:

For the second straight month, home sales dropped as Wisconsin recorded its coldest winter in decades according to an analysis of February housing market activity released by the Wisconsin REALTORS® Association (WRA). Existing home sales dropped 10.1 percent relative to February 2013; however median prices actually increased substantially, rising 7.4 percent to $130,000 over the same 12 month period.

“We live in Wisconsin. We expect slow sales in February,” said Steve Lane, chairman of the WRA board of directors. “But we broke many records for cold temperatures this winter, so it’s not surprising this year’s February sales were off the 2013 pace,” Lane said. “Weather extremes weren’t the only thing that conspired to dampen sales. Median prices have grown consistently since March of 2012 and mortgage interest rates have been climbing and are now almost a full percentage point higher than this time last year,” Lane said.

Below are the number of Home Sales and Median House Prices for the state of Wisconsin, Rock County, and Dane County. These stats include Janesville and Madison. Feel free to contact me if you have any questions pertaining to these figures. As you probably have heard, home sales & prices have been increasing over the past few years. This February showed a decrease of home sale statewide, but an increase in home prices. Dane County's prices stayed fairly stagnant year over year, while Rock County's median home price was up over 20%!

Thinking of purchasing a home before prices or rates rise any further?! I'd be happy to show you any homes currently listed for sale. Feel free to visit Rock County, WI Home Listings to search for current properties listed in Rock County or visit Dane County, WI Home Listings for homes in Dane County.

Now might be the right time to sell your Wisconsin home! If you would like some insight into how much your home is currently worth, I would be happy to provide you with a free comparative market analysis. This is a report that gives a close estimate to what your home might sell for in your current local Wisconsin real estate market. Click below:

What's My Wisconsin Home Worth?

Has your home value fallen below what you currently owe? Have you experienced a hardship like divorce or job loss? A short sale may be right for your situation. Visit our page on Wisconsin Short Sales for more information.

Housing Statistics for the State of Wisconsin:

February 2014

Home Sales: 3,338

Median Home Price: $130,000

February 2013

Home Sales: 3,688

Median Home Price: $121,000

Housing Statistics for Dane County, WI:

February 2014

Home Sales: 331

Median Home Price: $193,000

February 2013

Home Sales: 349

Median Home Price: $195,000

Housing Statistics for Rock County, WI:

February 2014

Home Sales: 109

Median Home Price: $97,500

February 2013

Home Sales: 108

Median Home Price: $78,700

View my report from last month. Wisconsin January 2014 Housing Statistics

Just Sold! 1303 E Koshkonong Dr, Milton Wisconsin 53534

Just Sold! 1303 E Koshkonong Dr, Milton Wisconsin 53534

We are happy to announce a recent home closing in Milton, Wisconsin. Although, this bank owned home may be a tear down, the lot and location really were ideal. Being just steps away from Lake Koshkonong made this REO property a super buy, listed at just $34,650. Congratulations to our Rock Realty buyer, Keith! We can't wait to see what you do with this great lake lot in Milton!

If you are thinking of selling or buying a home in Wisconsin, our home buyer specialists would be happy to assist you. Give Rock Realty a call at 877-774-7625. We are a full service real estate brokerage.

OTHER ARTICLES

- Getting Pre-Approved for a Mortgage Before Looking for a Home

- First Time Buyers: How To Wade Through Real Estate Lingo

- What’s Just as Important As Location When Choosing a Home?

- 10 Things that are Good to Know Before Buying a Home

- Tips for your first Home Inspection

- Tips for Purchasing a Foreclosure

- Tips for Picking the Right Wisconsin Home

Just Sold! 1817 Anhalt Dr, Madison Wisconsin 53704

Just Sold! 1817 Anhalt Dr, Madison Wisconsin 53704

We are happy to announce a sale for another Madison Wisconsin Rock Realty home seller!

This home was the perfect little tri-level on Madison's East Side. The buyers got a great price on this bank accepted short sale. Congratulations to the buyers and our sellers on this successful Madison short sale transaction!

If you are thinking of selling or buying a home in Wisconsin, our home buyer specialists would be happy to assist you. Give Rock Realty a call at 877-774-7625. We are a full service real estate brokerage.

OTHER ARTICLES

- Getting Pre-Approved for a Mortgage Before Looking for a Home

- First Time Buyers: How To Wade Through Real Estate Lingo

- What’s Just as Important As Location When Choosing a Home?

- 10 Things that are Good to Know Before Buying a Home

- Tips for your first Home Inspection

- Tips for Purchasing a Foreclosure

- Tips for Picking the Right Wisconsin Home

We would like to introduce you to our home buyer specialist, Eric Engels, Realtor® | Real Estate Agent serving the Janesville, Wisconsin area!

"Hello Rock County! I am very happy to have joined the Rock Realty team. I have been a resident of Janesville for over 13 years. I lived in the Quad Cites before that living in both Illinois and Iowa. In 2006 I had the chance to move back to the Quad Cites, I thought about it for about 2 seconds, but Wisconsin is the best place to live I couldn't leave. I am a big fan of the Midwest way of living! I am very excited to meet some of the great people in Rock County, and to help them in there home buying and selling needs."

"Hello Rock County! I am very happy to have joined the Rock Realty team. I have been a resident of Janesville for over 13 years. I lived in the Quad Cites before that living in both Illinois and Iowa. In 2006 I had the chance to move back to the Quad Cites, I thought about it for about 2 seconds, but Wisconsin is the best place to live I couldn't leave. I am a big fan of the Midwest way of living! I am very excited to meet some of the great people in Rock County, and to help them in there home buying and selling needs."

"At Rock Realty we use the newest and most innovative technology to help us in our advertising and researching needs. Please feel free to call or e-mail me with any questions you may have. Again I look forward to meeting the great people of Rock County."

Thanks

Eric Engels

Visit my site to search for Janesville, WI Real Estate Listings:

www.JanesvilleListings.com

(Homes for sale in 53545, 53546 and 53548 and the rest of Dane & Rock County)

We would like to introduce you to our home buyer specialist, Bethany Alexander, Realtor® serving the Oregon, Wisconsin area!

Real Estate Agent/Realtor®

608-212-4101 (cell)

Bethany@RockRealtyWI.com

www.SweetHomeWI.com

Rock Realty Client Testimonials

"I had a very challenging home sale and Mike Collins was diligent every step of the way. The most difficult aspect may have been me, I was very specific about which closing dates worked and how I wanted to proceed. Mike patiently answered all of my questions and accommodated all of my requests. When issues between the title and mortgage companies arose, Mike was a swift and competent negotiator. I know that the buyer's agent was very impressed with Mike as well. My house had an accepted offer within 10 days of listing. I am amazed that it all went so smoothly. THANKS MIKE!"

John B.(Madison, WI)

Rock Realty Seller Client

Thanks for the compliments, and Congratulations on your closing John!

photo credit: QuidnuncQuixot via photopin cc

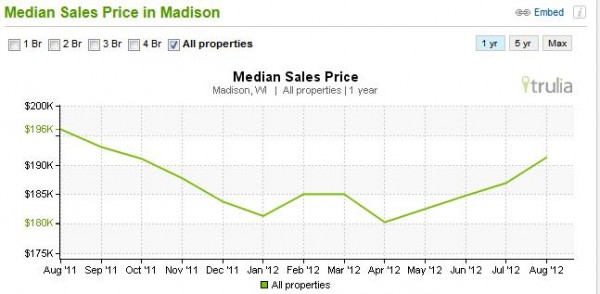

Home Prices in Madison Show Improvement

Lots of good news about the Wisconsin real estate market has come out over the past two months. Home prices are beginning to improve, homes are selling a bit quicker and foreclosures are down. All of this points to improvement in the real estate market. Listed below are some facts about prices in Madison based on various parameters.

Overall, home prices have been growing steadly since April of 2012. The following chart, provided by Trulia, shows the average sales price across all types of homes

Although home prices have not returned to the average of $196,000 like it was last year, it is getting close. When comparing home prices at different tiers, Madison is staying ahead of the rest of the state in all three tiers. The following charts are from Zillow. This first chart points out two facts. First, the average price for a home in Wisconsin in the upper tier is around $232,000. However, for Madison the price is approximately $295,000. This points to the continued growth in the Madison area. Secondly, while the average price in this tier only increased 0.2% for the state of Wisconsin, in Madison the price improved by 1.6%

For the middle tier pricing, the average price in Wisconsin is $142,000 compared to $187,000 in Madison. This tier has also seen an increase from the last quarter, although not as strong as the higher tier.

Although the bottom tier in Madison has not shown as strong a price increase as the rest of the state, it is still moving up, which is a good indication.

When looking at homes based on size, there is even better news all around. Homes at every size in Madison have shown increase in value over the past few months, as evidenced by this chart from Trulia.

No. Bedrooms | May - Jul '12 | 3 months prior | 1 year prior | 5 years prior |

1 bedroom | $156,200 | $145,000 | $166,000 | $167,000 |

2 bedrooms | $165,000 | $141,500 | $155,000 | $172,250 |

3 bedrooms | $185,000 | $180,000 | $194,250 | $210,000 |

4 bedrooms | $239,500 | $232,250 | $245,000 | $267,500 |

All properties | $191,250 | $182,500 | $196,000 | $204,900 |

Based on these figures, the average price across all home sizes has increased an average of 4.5% in the past three months.

We are happy to announce the closing on another one of our short sale listings, this time in Madison, WI! This was a Bank of America negotiated short sale. Bank of America has made many changes to make their short sale process easier and more efficient. Short sale transactions can be complex, but if you have an experienced Short Sale Realtor® the process is much more manageable.

We are happy to announce the closing on another one of our short sale listings, this time in Madison, WI! This was a Bank of America negotiated short sale. Bank of America has made many changes to make their short sale process easier and more efficient. Short sale transactions can be complex, but if you have an experienced Short Sale Realtor® the process is much more manageable.

This was a beautiful home, at a great price that the new owners are sure to enjoy! If you are thinking of selling or buying a short sale home in Wisconsin, our short sale specialists would be happy to assist you. Give Rock Realty a call at 608-921-8536.

Is a Short Sale right for my situation??

If you are considering the possibility of a short sale for your home and have further questions, feel free to visit the page below:

Number of Foreclosures Showing Signs of Decreasing

The number of foreclosures in July 2012 is 10% lower than the amount from July 2011. Finally, it looks like the real estate market is making solid improvement. In fact, July 2012 is the 22nd month, in a row, to show a decline in foreclosure activity when compared to the same period from the previous year.

Overall, there is a 20%+ decrease in the annual number of homes being taken over by banks. The trends are taking place in at least 38 states as well as Washington, D.C.

As a whole, the nation is seeing that one home out of 686 homes is either in foreclosure or on the verge of repossession.

In comparison, Wisconsin shows one home out of 701 is facing foreclosure. Coupled with the news from last month that housing prices are on a steady rise; it does seem that the real estate market is getting back on the right track.

What does this mean for Buyers and Sellers?

In order to see how this is a good thing for both buyers and sellers, we have to look at the big picture. Fewer homes facing foreclosure would indicate that people who were out of work, or working at below average wages for their skill set, are now finding better paying jobs. The better jobs obviously are resulting in more money, aiding these families to get current on their bills. This would indicate the overall job market is improving. A better job market means more potential buyers that can purchase a home. That is great news for people who are in a position to sell a home.

The same type of facts has an impact on people looking to buy a home. An improving job market is good for those people that were out of work, fresh out of college or working at a job that was enough to pay the bills while they searched for a better option. More employment translates to more income, leading to more savings and an improved ability to pay for a mortgage.

What remains to be seen is the impact these improvements will have on the lending industry. One of the main problems that led to the real estate crash is the loose requirements that were in place allowing almost anybody access to a home mortgage. It is doubtful that mortgage lenders will return to those kinds of practices. However, it is a good assumption that lending rules will ease a bit in the coming months to help borrowers take advantage of the unprecedented rates that we have experienced for the last 3 years.

Here is today's market listings update for Active foreclosure single family homes located in Rock County Wisconsin. This information was pulled from the South Central Wisconsin MLS on 3/7/2012 at 8:30 A.M.

- 59 total Foreclosure|Bank Owned|REO homes are currently listed in Rock County, WI

- Low listing price: $10,000

- High listing price: $369,900

- Average listing price: $85,857

- Median listing price: $60,000

- Average days on the market: 63

Of course these numbers change on a daily basis, so to obtain the most up to date information on current foreclosure/bank owned homes for sale, please contact us directly at 608-921-8536. We would be happy to customize the search further for you to find the home that is just right for you.

As an extra benefit to Rock Realty home buyers, we offer a 1% broker commission rebate after closing. This could mean $1,500 back on a home purchase of $150,000. We love to hear how these rebates help our clients. Some use them for home improvements, while others simply put it in savings for future needs. It is a great option that we are happy to offer. Contact us for further details and limitations.

At Rock Realty, we currently have great single family homes listed for sale in Rock County. Feel free to visit our listings page linked below:

Rock County Wisconsin Home Listings

Additional Foreclosure|Bank Owned Home Purchase Information

Here is today's market update for Active single family foreclosure and bank owned home MLS listings located in Madison Wisconsin. This information was pulled from the South Central Wisconsin MLS on 2/15/2012 at 10:45 A.M.

- 42 total Foreclosure|REO|Bank-Owned home listings in Madison, WI

- Low listing price: $58,000

- High listing price: $340,000

- Average listing price: $152,235

- Median listing price: $149,500

- Average days on the market: 57

There are some fantastic deals available right now! Of the 42 foreclosure listings in Madison, 21 of them are listed for under $150,000. These numbers change on a daily basis, so to obtain the most up to date information, please contact us directly at 877-774-7625 or email us at Info@RockRealtyWI.com. If you are looking to buy a discounted home in Madison Wisconsin, we would be happy to customize the search further for you to find the home that is just right for you.

As an extra benefit to Rock Realty home buyers, we offer a 1% broker commission rebate after closing. This could mean $2,000 back on a home purchase of $200,000. We love to hear how these rebates help our clients. Some use them for home improvements, while others simply put it in savings for future needs. It is a great option that we are happy to offer. Contact us for further details and limitations.

Original Post - Foreclosures in Madison Wisconsin

Here is today's market update for Active foreclosure and bank owned home MLS listings located in Janesville Wisconsin. This information was pulled from the South Central Wisconsin MLS on 2/14/2012 at 2:50 P.M.

- 26 total Foreclosure|REO|Bank-Owned home listings in Janesville, WI

- Low listing price: $45,500

- High listing price: $679,900

- Average listing price: $118,167

- Median listing price: $84,000

- Average days on the market: 82

There are some fantastic deals available right now! Of the 26 foreclosure listings in Janesville, 19 of them are listed for under $100,000. These numbers change on a daily basis, so to obtain the most up to date information, please contact us directly at 877-774-7625 or email us at Info@RockRealtyWI.com. If you are looking to buy a discounted home in Janesville Wisconsin, we would be happy to customize the search further for you to find the home that is just right for you.

As an extra benefit to Rock Realty home buyers, we offer a 1% broker commission rebate after closing. This could mean $2,000 back on a home purchase of $200,000. We love to hear how these rebates help our clients. Some use them for home improvements, while others simply put it in savings for future needs. It is a great option that we are happy to offer. Contact us for further details and limitations.

Original Post - Foreclosure Listings - Janesville, WI

I read the article below, this may explain the excessive drop in REO listings in my area. Perhaps once these settlements are comlete things can finally get back to normal. We need to clear out the backlog of REO properties before this market will stabilize.

From HousingWire:

More than 40 states to sign foreclosure settlement

More than 40 states will sign a settlement with the top-five mortgage servicers over alleged foreclosure abuses that arose more than one year ago, Iowa Attorney General Tom Miller said in a statement Monday night.

Last week, Miller extended the deadline to Monday for states wanting to sign the deal with Bank of America ($7.97 0.13%), Wells Fargo ($30.20 -0.43%), Citigroup ($33.30 -0.24%), JPMorgan Chase ($38.14 -0.14%) and Ally Financial ($22.95 0.03%).

“The sign-on deadline for the proposed joint state-federal mortgage servicing settlement passed Monday with more than 40 states signing on,” Miller said “This enables us to move forward into the very final stages of remaining work.Federal and state officials, as well as representatives from the banks, continue to address matters that they must complete before finalizing any settlement.”

Throughout the day, those representing states hardest hit by the foreclosure crisis signaled they are still working on the details of the settlement.

“We’re closer,” a spokesperson for California AG Kamala Harris said.

“My office is continuing to review the intricate draft settlement terms and advocating for improvements to address Nevada’s needs,” said Nevada AG Catherine Cortez Masto in a statement. “Receipt of important state specific information is necessary to make our determination and my office is still in discussions regarding that information.”

Florida AG Pam Bondi said she “remains involved in the settlement discussions in order to reach the best resolution for Floridians and all Americans.” She signed a joint letter with other republican AGs in 2010, saying a settlement that would involve principal reduction creates a moral hazard and lead to more strategic defaults.

…

An official in one AG office said an announcement is expected at the end of this week at the earliest.

From Bloomberg:

California, N.Y. Are Among Fewer Than 10 Mortgage Deal Holdouts

California and New York’s attorneys general haven’t signed on to a proposed settlement with five banks over foreclosure practices that has won the support of more than 40 states.

California’s Kamala Harris and New York’s Eric Schneiderman, who have been some of the most outspoken in pushing for changes to the deal, are among those who hadn’t joined the agreement as of yesterday’s deadline for states to decide. More than 40 states signed on to the accord, according to Iowa Attorney General Tom Miller, who is helping to lead talks with the banks.

“Adding more numbers probably improves the political dimension of the settlement from the standpoint of the attorneys general,” said Ken Scott, a Stanford University law professor. “If you can say there were only a handful of diehards that didn’t sign on, that gives you some political protection.”

…

Bank of America Corp., JPMorgan Chase & Co. and Wells Fargo & Co. made a last-minute demand that New York drop claims filed against them Feb. 3 as a condition of the settlement, a person familiar with the matter said.The push by the three banks raised a new obstacle in getting Schneiderman’s support for the deal, said the person. New York, along with California, Nevada and Delaware said late yesterday they hadn’t signed on to the settlement.

New York sued Bank of America, JPMorgan and Wells Fargo in state court in Brooklyn, saying their use of a mortgage database known as MERS led to improper foreclosures. Schneiderman said the banks’ use of the Mortgage Electronic Registration Systems database misled homeowners, undermined foreclosure proceedings and created uncertainty about ownership interests in properties.

Youtube can be one of the most powerful tools for both showing asset managers your marketing abilities and generating leads for yourself from around the world. With the correct use of Property Addresses through Google Maps your YouTube Channel can be a showplace for both you and your properties. Take a look at this example www.youtube.com/RealtorVincent

Call me if you want to learn more Dominic (EMS) 239-200-8141.

If you are a RE/MAX Agent your in luck!!! Ask me why. . .

Close Your Eyes So You Can See

I've always heard that when you lose one of your five senses that the other ones become more intense. Recently I was resting my eyes (taking a nap), and I heard a commercial on the radio that has a TV counterpart. When I heard it on the radio I recogniz ed it right away. Only this time, it was different.

ed it right away. Only this time, it was different.

This time, the sound was amplified, and I heard the emotion in the voice of the speaker. Her voice was silky smooth on the radio. It didn't seem that smooth on TV, but there were distractions on the TV ad that I couldn't see with the radio ad. It was the same ad. What was the difference? Since I couldn't see her this time my hearing was making up for my lack of sight, and it was an amazing difference. Wow! I was so surprised.

What does that have to do with real estate? A lot! When you list a house  you need to list it with a buyer's senses in mind. I recently did a walk through of one of my own listings. I made up my mind that I was going to walk into this house as if I had never seen it, and I was going to determine why it hadn't sold yet. I exhanged my Realtor senses for a buyer's senses, and I found a lot of things that would keep me "the buyer" from buying the house.

you need to list it with a buyer's senses in mind. I recently did a walk through of one of my own listings. I made up my mind that I was going to walk into this house as if I had never seen it, and I was going to determine why it hadn't sold yet. I exhanged my Realtor senses for a buyer's senses, and I found a lot of things that would keep me "the buyer" from buying the house.

So, close your eyes and listen. Listen to something that you're already familiar with. What did you hear that you haven't noticed before? Now carry that into one of your listings that is moving slowly. What do you see that you didn't see at the initial listing? Close your Realtor senses, and open your buyer senses. You might be surprised.

Sellers want to sell, and Realtors want to sell. So, what's the problem?

Sellers want to sell, and Realtors want to sell. So, what's the problem? The problem is some sellers lie, and some Realtors lie (no offense to my colleagues  ), and it slows down the process. Yahoo Finance posted an article today called "The 5 Lies All Home Sellers Tell." Drop by and check out the article. We've all heard it before.

), and it slows down the process. Yahoo Finance posted an article today called "The 5 Lies All Home Sellers Tell." Drop by and check out the article. We've all heard it before.

But what about Realtors? Most of my friends who are in this business are awesome. I am proud to call them friends, and we do business together constantly, but there is another group. Let me tell you about my day.

I just left a client's home. She has her property listed with another company. Actually, it has been listed for over a year. In that year's time, her Realtor has  never been by except to have her sign documents. There isn't even a sign on the property. There have been three showings and zero offers. The sad part about this house is that it's a great house on 82 acres of beautiful rolling hills, but it's being handled by a Realtor who would say anything to get the listing.

never been by except to have her sign documents. There isn't even a sign on the property. There have been three showings and zero offers. The sad part about this house is that it's a great house on 82 acres of beautiful rolling hills, but it's being handled by a Realtor who would say anything to get the listing.

Here's the irony. I did all of the CMA work, research on conservation easements and laid the ground work for her to sell two years ago. I never heard from her again, a la "Dear Customer - I have a favor to ask" by Karen Crowson. A local attorney in her area recommended a different Realtor, and here she is a year plus later with nothing. That Realtor promised the moon. He would market vigorously, he would send out fliers, he swore he had five clients right then who had cash and one of them would scoop the property up right away. Baloney!

Some Realtors will say anything to get a listing, and then what? If it turns out to be hollow promises, like this Realtor's promises, the client, who is in desperate nee d, is left hanging and confused because she is holding on to the promises that had no substance. She believed in the recommended Realtor. She trusted his listing presentation, and he had a slick one. She was excited to get the property listed. Now, she is in financial trouble because she chose a Realtor who was only gathering listings to fluff his portfolio, and he didn't have a genuine plan for selling.

d, is left hanging and confused because she is holding on to the promises that had no substance. She believed in the recommended Realtor. She trusted his listing presentation, and he had a slick one. She was excited to get the property listed. Now, she is in financial trouble because she chose a Realtor who was only gathering listings to fluff his portfolio, and he didn't have a genuine plan for selling.

I once had a college professor who often said, "If you make a promise that something will happen you had better be prepared to make it happen." That's good advice for all of us. We should only promise what we know we can make happen because people trust us, and they need to know that we can do what we say we can do.

Ok, I was reading Jessie's 2011 take on "How do I get my first REO listing?" and it got me thinking. So many agents think that once they get an REO listing they'll be on the easy money train. It just does not work that way. If this is the niche you decide to choose, be prepared, it is not glamorous.

First there are the properties, sure you might get lucky and get some 3 year old mini mansion, but more likely you'll get a mixture of suburban and urban properties to sell. In the past year, more than half of my REO's have had no plumbing- copper stripped, yet some still occupied. I have had to deal with flea infestations, break ins, police reports, fire reports, lead paint liens, city registration inspectors, abandoned pets, water penetration and mold.

Next there are the people. At times you'll be dealing with innocent tenants that have lived in the property for years and have no idea that the property has been foreclosed. You will be the bearer of the bad news that even though they paid their rent on time, the owner chose not to pay the mortgage. Other times you will meet with the former owner, and they will feel compelled to tell you their story. Some of these stories will break your heart, especially the ones when the foreclosure was caused by an illness or job loss.

Lastly there is the paperwork, not just a standard listing agreement and some disclosures, much, much more. There's initial occupancy checks, initial BPO, monthly marketing reports, updated BPO's, offer submission forms, utility invoicing paperwork, relocation assistance agreements, contractor repair bid forms and most of these documents need to be uploaded into a system.

Now I am not trying to discourage anyone from the REO business, just trying to give you a bit of reality.

So, How do I get my next REO listing? Plenty of tips are already posted on REOPro, but to reiterate;

1. Be available to your AM 24/7

2. Respond to requests immediately- get a blackberry, IPhone whatever you need to get this done.

3. Ensure all your paperwork is accurate and early, not just on time.

4. Anticipate your AM's needs, Know your AM's temperament.

5. Visit the property-often. Nothing is worse than not knowing about something that happened to one of your properties. You should always be the first to know.

6. Remember DOM=$$$$ Make sure every offer you submit is with a purchaser that is pre-approved or has proof of funds.

As an example today I trudged through over 29" of snow to do an initial occupancy check, so it would be in less than 24 hours from assignment, but that is how I will get my next REO listing.