Exciting News! FHA Is Allowing People that Suffered through Recent Economic Hardships to Apply for a Home Loan with the FHA Back to Work Program.

- photo credit: Daquella manera via photopin cc

In the not so distant past people had to wait 3 years or more after suffering through a financial hardship. Bankruptcy, foreclosures and other major financial disasters would sideline people for a number of years before they could buy a house again. However, all that has changed with the FHA Back to Work Program.

Previous Guidelines

For years the FHA program has helped people finance the purchase of a home with a modest 3.25% down payment. In general, the FHA rules for credit and employment history were more forgiving than conventional loan guidelines. However, there were strict rules about waiting a significant length of time after filing bankruptcy, losing a home to foreclosure, getting a loan modification or a deed-in-lieu.

New Guidelines

The Back to Work program waives waiting periods based on certain hardship situations. People that have suffered through the following types of problems are no longer forced to wait multiple years to apply for an FHA loan

* Bankruptcy (either Chapter 7 or Chapter 13)

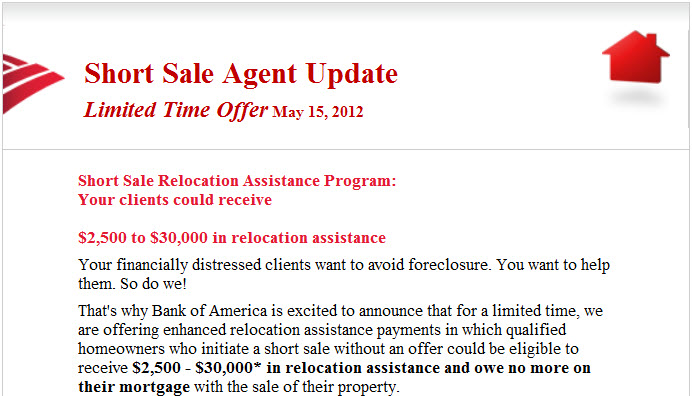

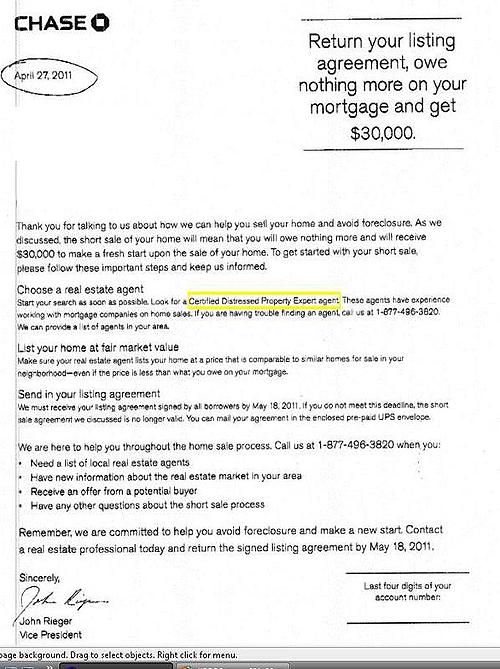

* Short sale of previous home

* Foreclosure

* Modification of previous mortgage

* Sale of a home due to pre-foreclosure status

* Deed-in-lieu

Due to the recession of the past few years the government has given FHA the ability to relax their rules in order to help people qualify for home loans. Now people will only have to wait 12 months.

Meeting the New Qualifications

For borrowers that have faced a hardship like the ones described above they will need to meet a few qualifications.

First the borrower will need to prove that their current financial condition is recovered from the impact of the financial hardship.

Second, the borrower will need to provide proof that their income declined by a minimum of 20% for 6 months or longer. This can usually be shown by presenting federal tax returns and the supporting W-2 forms.

Finally the borrower will have to agree to complete a counseling session aimed at educating home buyers.

In addition to these items the borrower must re-establish their credit. This does not mean that the scores must be 700+. However, once the hardship has ended the borrower will need to have good payment history on all credit accounts in order to prove that they are able and willing to make their monthly obligations.

Types of Borrowers

The Back to Work program can be used for people buying their first home as well as people buying their second, third, fourth, etc. home. It can also be used with the FHA 203(k) program for people that wish to renovate or modernize a home. Even people that are currently in a Chapter 13 plan could be approved for the FHA back to work program. The court will have to grant permission for the loan and the borrower will have to meet the other requirements.

The recent recession has hit a lot of people and left a lasting impact on them. The Back to Work program is aimed to help these people put the past behind them and return to the stability of owning a home.

Additional Mortgage Information: Mortgage Home Loans Financing